Our Guide to the Federal EV Tax Credit

2024 Incentivize Guide to the

Clean Vehicle Tax Credit

Incentivize is here to make EV incentives easy. And no incentive is bigger or has had quite as many iterations as the federal government’s Clean Vehicle Tax Credit, which can save you as much as $7500 on a new EV. Understanding which vehicles qualify for it is the natural starting point for many people at the beginning of their EV buying journey. Thanks to the provisions of the Inflation Reduction Act, eligibility rules have been changing quite a bit. But don’t worry we got you covered.

First, select “Only EVs w/ Federal Tax Credit” under Electric Vehicle Information to narrow your search when you use the Incentivize Rebate Calculator. Second, read this blog to learn why only certain models and trims qualify and to see them in a clear, easy to read list. There are also a few other factors to keep in mind.

Leasing has much more liberal criteria than buying as it falls under the commercial EV tax credit. Your personal income becomes irrelevant as do the rules around battery composition and final assembly. It is really up to the auto dealer to pass on some or all of those savings to you in the lease terms, but it means a much wider variety of EVs can be accessed for savings

Point of sale use of the CTVC is happening now at registered dealers. That’s good news because it means the CVTC can now be used to lower the purchase price at the dealership! Of course, there are some good, bad and ugly things to keep in mind.

Good: Even if you don’t have tax liability or just have a modest amount, the full $7500 credit can be applied to qualified purchases at the dealership.

Bad: If you take the credit to buy a vehicle at the dealership, but your income exceeds the limits for the CVTC when you file, you will owe the IRS money back.

Ugly: If you don’t obtain a point of sale rebate at your local dealership, you must still buy your EV from a dealer that’s been registered with the IRS in order to claim the credit on your tax return. The kicker is that there’s no easy way yet to know which dealers are currently registered with the IRS! (Thanks to our friends at Green Energy Consumers Alliance for flagging this issue)

Ugly: The dealer must file a “time-of-sale report” with the IRS that has your vehicle's VIN #. You’ll want a copy of that report and a confirmation from the IRS,along with Form 8936 for later when you file your tax return.

Good: If you bought an EV in 2023, you still have until April 15th to file for the tax credit under the 2023 rules.

Used EVs purchased for $25,000 or less have their own tax credit of up to $4,000, limited to 30% of the car's purchase price. This is also non refundable credit. The IRS website has a number of other rules, (including income limits which we included below) but one key rule stands out - the used EV must be a model year at least 2 years earlier than the calendar year when you buy it. So, for this year it would need to be from 2022 or older.

Here are the latest eligibility rules for an electric vehicle purchase to qualify for the Clean Vehicle Tax Credit:

The buyers must meet annual income limits, which vary based on how you file your federal taxes:

$300,000 for married filing jointly ($150,000 for used EVs)

$225,000 for heads of households ($112,500 for used EVs)

$150,000 for other filers ($75,000 for used EVs)

Vehicles cannot cost more than $55,000 for passenger cars or $80,000 for trucks, vans and SUVs and qualify for the tax credit. Turns out the majority of qualifying vehicles in 2024 are SUVs and trucks.

The vehicle must have at least a 7 kilowatt-hour battery capacity and weigh less than 14,000 pounds.

It should be used primarily in the U.S. and not for resale.

Most critically, the vehicle must have undergone final assembly in North America and meet specific battery and mineral component requirements, which are dynamic and go up incrementally each year until 2029! That’s a lot to keep track of for anyone, so we thought it would be helpful to simply provide a list of all qualifying vehicles electric vehicles (EV) and plug-in hybrid electric vehicles (PHEV) that currently qualify for the Clean Vehicle Tax Credit

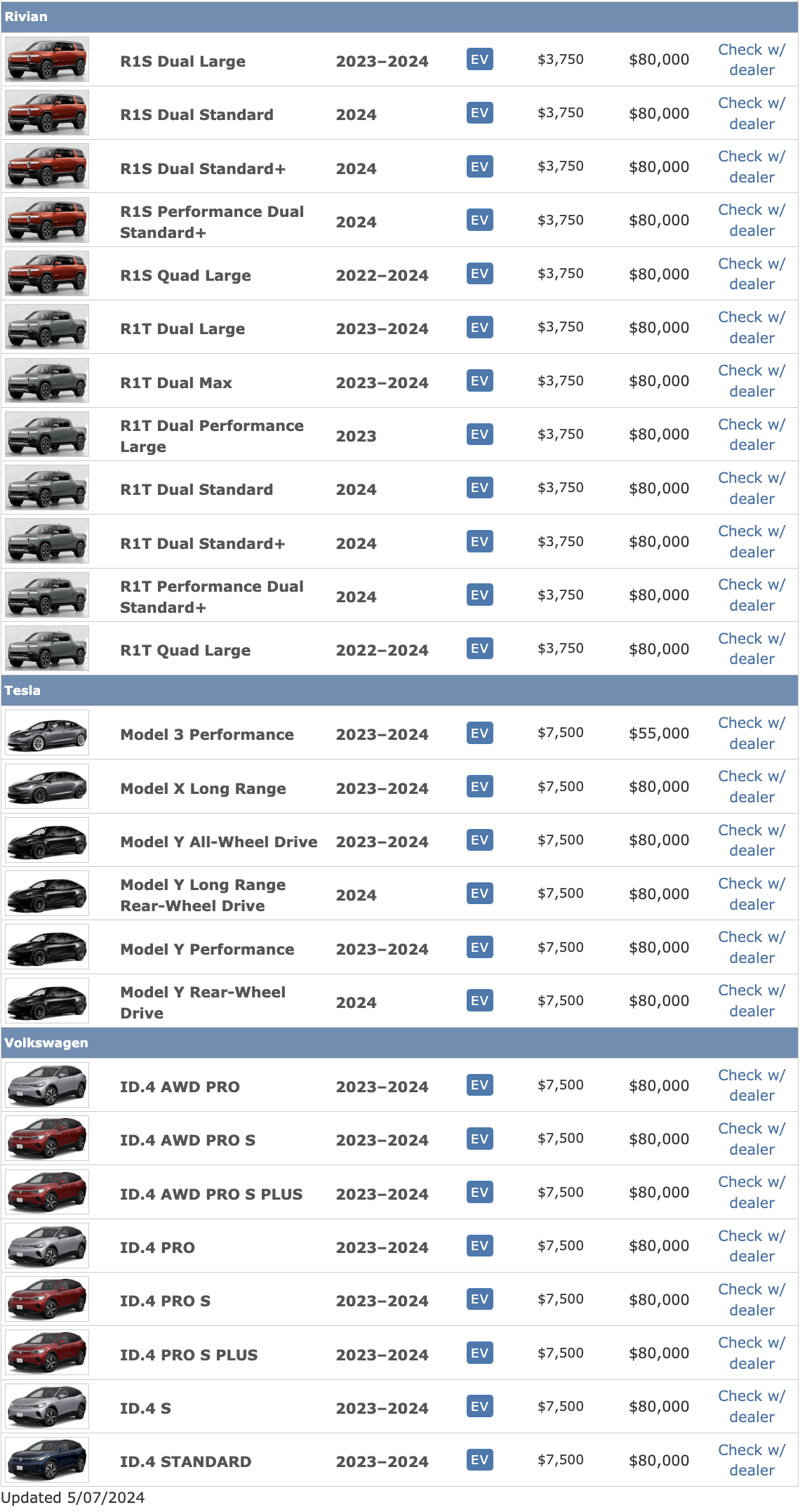

The 2024 Eligible Vehicles for the Clean Vehicle Tax Credit along with their maximum credit amounts and price limits: